2013(1) Ayele

Contents

1. Introduction

2. The special nature of bank corporate governance

3. Basic features of bank corporate governance in Ethiopia

3.1. Absence of a share market

3.2. Mix of politics and Business

3.3. Inadequate shareholder protection laws

4. Bank regulation in Ethiopia: the regulatory power of the National Bank

4.1. Regulating transparency and disclosure

4.2. Regulating Board rights and duties, and risk management

5. Corporate governance and private banks in Ethiopia

5.1. Corporate governance mechanisms and bank performance

6. Conclusions

7. References

Revisiting the Ethiopian Bank Corporate Governance System: A Glimpse of the Operation of Private Banks

Asnakech Getnet Ayele

Abstract

The overall standard of corporate governance in Ethiopia is inadequate. Among the factors which show such a poor standard is, firstly, the absence of an adequate legislative framework to regulate modern complex bank governance issues give rise to inefficient banks. Secondly, political parties’ involvement in business enterprises is impeding effective competition by the private sector. Thirdly, inadequate shareholder protection laws and the ineffective judicial system that causes expropriation of shareholders’ wealth by denying businesses legal safeguards. The absence of an organized share market also makes valuation and price discovery of banks difficult. Besides this, there is a major credibility problem in the Ethiopian banking regulatory environment, since the regulatory rules are enforced discriminately between state and private banks. This article also questions the impact of the two major aspects of corporate governance, namely, ownership structure and board structure on bank performance. By exploring best bank governance practices and international bank governance principles, this article suggests bank corporate governance in Ethiopia needs overhauling and adoption or adaptation of good corporate governance principles.

This is a refereed article published on: 31st July 2013.

Citation: Ayele, A.G. ‘Revisiting the Ethiopian Bank Corporate Governance System: A Glimpse of the Operation of Private Banks’, 2013 Law, Social Justice & Global Development Journal (LGD).

Keywords

Corporate governance, bank corporate governance, bank regulation, and aspects of corporate governance, bank performance

Abbreviations

CBE Commercial Bank of Ethiopia

CEO Chief Executive Officer

Com C The Commercial Code of Ethiopia

EFFORT Endowment Fund For the Rehabilitation of Tigray

EPRDF Ethiopian Peoples Revolutionary Democratic Front

NBE National Bank of Ethiopia

OECD Organization for Economic Development and Cooperation

TPLF Tigray Peoples Liberation Front

1. Introduction

A complex framework characterizes bank corporate governance as it encompasses a wide range of stakeholders including shareholders but also depositors, creditors, suppliers, employees, and regulatory bodies.[1] The unique features of banks necessitate strict government regulation through bank supervisors and a range of banking laws and regulations.[2] The interface between these elements determines how well the performance of a bank conforms to the best interest of shareholders, while complying with regulatory standards.[3] Hence, for shareholders and regulators the bank corporate governance framework is critical for the bank’s success and its daily operations.[4]Good corporate governance fosters efficient monitoring of corporate assets, effective risk management and greater transparency of banking activities helps to achieve and maintain public trust and confidence in the banking system.[5] In contrast, poor corporate governance may contribute to bank failures, which could, in turn, trigger a bank run or liquidity crisis.[6] In addition, it is associated with “crony capitalism” that transmits shocks leading to bankruptcy and contagion resulting in adverse impacts on the financial system of a country.[7]Though there is no single model of good corporate governance and no one size fits all model, there are some principles that have been developed by the OECD, the Basel committee on banking supervision, the UK Cadbury report of 1992, and others.[8] These principles cover the following areas: rights of shareholders; equitable treatment of shareholders; the role of stakeholders; disclosure and transparency; and responsibilities of the board.[9] Moreover, the World Bank has proposed guidelines for good corporate governance in the financial sector seeing the sector as an engine for robust economic growth, and for effective transmission of monetary policy.[10]This article attempts to deal with the basic features of bank corporate governance in Ethiopia that contribute to its poor performance and indicate the legal and policy changes which need to be made to tackle these problems. It also examines the operation of some selected private banks in light of various aspects of corporate governance. However, the article neither claim to provide a perfect solution for all bank corporate governance problems in Ethiopia nor does it expose the vast corporate malpractices which are alleged to exist in the banking industry for this can hardly be achieved in the current crude state of corporate disclosure.[11]This work starts by defining corporate governance, and then it discusses the special nature of bank corporate governance and agency problem in banks. The second section examines the Ethiopian aspect of corporate governance and critically analyzes its main features by pinpointing the mix of politics and business, absence of share market, inadequate shareholder protection laws, and the ineffective court system. The Ethiopian bank regulatory environment is also discussed under this section. The third section questions the link between corporate governance and bank performance in five Ethiopian private banks. For this purpose it considers some aspects of corporate governance. The conclusion underlines the implications of the issues discussed and suggests possible recommendations.Defining Corporate GovernanceCorporate governance has been defined in different ways by different authors.[12] (Shleifer and Vishny, 1997) define corporate governance as the ways in which suppliers of finance to corporations make sure of getting a return on their investment.[13] (Gillan and Starks, 2008) take a broad perspective on corporate governance and define it as the system of laws, rules, and factors that control operations in a company.[14] The Organization for Economic Cooperation and Development (OECD) offer a more comprehensive definition of corporate governance as a set of relationships between management of a corporation, its board, its shareholders and other stakeholders, while also providing the structure through which corporate objectives are set, and the means of attaining those objectives and monitoring performance are determined.[15]From these definitions, it may be stated that corporate governance frameworks establish systems of accountability and responsibility between the company and its major constituencies by defining the nature of the relationship.[16] In this article the definition provided by Shleifer and Vishny is chosen since it is in harmony with the unique nature of banks that requires adopting a broader view of corporate governance, which encapsulates both shareholders and depositors.[17]

2. The Special Nature of Bank Corporate Governance

Because of the opaque nature of banks and heavy government regulation, corporate governance works differently in the banking sector.[18] Banks are generally more opaque than nonfinancial firms, and evidence suggests that informational asymmetries are larger in banks than in other sectors.[19] The true value of a bank’s loan portfolio is not readily observable and can be hidden for long periods.[20] Moreover, banks can change the risky nature of their assets more quickly; they can hide problems by extending loans to clients that cannot service previous debt obligations.[21] Because of this, bond analysts disagree more over the bonds issued by banks than over those of nonfinancial firms.[22]

The multifaceted and sensitive role, which banks play in the economic system normally, draws government’s attention through heavy regulation.[23] Banks perform as liquidity guarantors, sources of non-market finance, information brokers between lenders and borrowers, and payment system operators.[24] All these features of banks coupled with the opacity of bank assets and activities forces governments to impose an elaborate array of regulations on banks.[25]

The strict regulation of banks, more often than not, imposes a natural hindrance to corporate governance mechanisms.[26] This is the case when regulation imposes restrictions on concentration of ownership, entry, takeover, bank activities, or when it designs deposit insurance. All have the possibility of reducing the effectiveness of mechanisms designed to control management by shareholders.[27] Limitation on concentrated ownership reduces the control of managers by large shareholders as the latter have the impetus to acquire information and monitor managers by electing their representatives to the board of directors.[28] Likewise, restrictions on hostile takeovers reduce the ability of outside bidders to make a credible takeover threat and improve the governance system in a bank.[29]

The most extreme form of government regulation of banks is ownership of banks.[30] Government ownership of banks presents a problem for corporate governance since it creates a situation of conflict of interest between the state both in acting as an owner and a regulatory authority.[31] The managing of the bank is also handed to bureaucrats who are unlikely to maximize firm value, but rather cater to the interests of specific groups.[32]

The unique nature of the banking firm requires the legal protection of depositors equally as that of shareholders.[33] For this reason, the government provides explicit deposit insurance and the implicit guarantee of bailing out of large banks to avoid bank runs and hence maintain financial system stability.[34] Deposit insurance might encourage economic agents to deposit their wealth with a bank, as a substantial part of the moral hazard cost is borne by the government.[35] Unfortunately, such public safety nets engender moral hazard problem in banks as it may encourage banks opportunistically to engage in more risky ventures.[36] To ameliorate moral hazard costs, the government can use economic regulations such as asset restrictions, interest rate ceilings, and reserve requirements.[37]

2.1. Agency Problem in Banks

Although the modern corporation has the status of an artificial person under commercial law, it is generally owned by physical persons, directed by a dozen or so individuals who are supposedly acting on the owners’ behalf, and run by a deep hierarchy of managers.[38] The vast and complex network of obligations between owners, directors, managers and employees who think on behalf of the organization and also on behalf of them can succinctly be described as agency problem.[39]

Agency problems arise because there is a divergence of interest between shareholders and managers and due to information asymmetry between them.[40] Managers use their full control rights to pursue projects that benefit them rather than investors.[41] Opportunistic managerial behaviours are manifested in shirking, empire building, and expense preference or, in the extreme outright expropriation.[42] Experience has shown that managers may misappropriate corporate assets whenever they get an opportunity to do so.[43] For example, in the “Enron” era the root cause was the transfer of wealth from the corporation and its shareholders into the bank accounts and stock portfolios of senior executives.[44]

Agency problems in banks not only occurs in the conflict of interests between managers and owners, but also in broader conflict areas, such as shareholders through managers versus bondholders or depositors, major shareholders versus minor ones, and management versus supervisory bodies.[45] Such agency problems underpin the major features of regulatory structures, such as, capital requirements, deposit insurance, etc., and problems of incentive conflict between management and owners.[46]

There are several mechanisms to reduce the agency problem in banks apart from the power to hire and fire managers.[47] Performance pay can be employed to compensate managers for their efforts to serve the owners’ interests; dividend mechanisms can be used to reduce managerial intention to make overinvestment decisions financed by internal free cash flow[48]; using bonding mechanisms could curtail managerial moral hazard which potentially occurs when they are not restricted by bond contract.[49] Furthermore, the stock market, through the threat of hostile takeover, can be an important controlling mechanism.[50] Managerial waste and inefficiency tend to push down share prices, which make the firm a more attractive target for a buyout.[51] Take over gives the new shareholders both the power and the incentive to remove the old management.[52]

Even if the aforementioned mechanisms are essential, the magnitude of information asymmetries between shareholders and managers, as well, as the sheer cost associated with acquiring information impedes shareholders from effectively disciplining management.[53] The “Enron” scandals revealed, ample opportunity for managers to conceal this information, or to frustrate the attempts of shareholders to gain access to it, for instance, by corrupting the auditing process.[54]

3. Basic Features of Bank Corporate Governance in Ethiopia

The issue of corporate governance in Ethiopia is new.[55] The financial sector is still underdeveloped and largely owned and controlled by the government.[56] Thus, corporations, which can be defined by the principal-agent model and need the type of corporate reform experienced in the rest of the world, may not exist in large number in contemporary Ethiopia.[57] This section attempts to explore the predominant characteristics of the bank governance framework in Ethiopia viz. the absence of share market; mix of politics and business; inadequate shareholder protection laws, and an ineffective court system.

3.1. Absence of Share Market

In the economies of developing countries, there exists an apparent shortage of capital and this puts a constraint on the realization of economic development.[58] In this regard, securities markets play a significant role in economic development through mobilizing capital and channelling it to the most productive enterprises.[59] Recognizing such role of securities markets, more than a dozen African countries have established stock markets, but Ethiopia is not one of them.[60] Unlike its neighbours, Ethiopia still neither has a stock market that allows its firms to be listed in foreign stock markets.[61] As a result, valuation and price discovery of the existing companies is problematic.[62]

Historically, the Ethiopian market is not new to an organized public share market.[63] During the late 1950s and in 1960s there was a robust share dealing in Addis Abeba with dozens of corporate entities listed in it and on the exchange, shares from newly formed public companies were offered to the public and traded on a regular basis.[64] Trading practices and standards have been developed, and a smoothly operating market mechanism has been created.[65] However, the infant share market was nipped in the bud by the coming in to power of the socialist regime that nationalized all privately owned corporations.[66]

After the socialist government was changed in 1991, efforts were made to restore an organized money market by the Addis Abeba Chamber of Commerce.[67] However, it was frustrated by the debilitating policy of the government given that federal policymakers argue that a lack of regulatory framework to allows the functioning of share markets in Ethiopia.[68] Contrary to this, there are ample provisions in the Commercial Code to take care of share market dealings. The provisions of the Commercial Code of Ethiopia (Here after Com C) from Art 56 to Art 59, which deals with commercial brokers, can effectively regulate the activities of the would-be share-dealing group.

Ironically, transactions of shares are taking place in many banks and, in November 2010; the United Bank SC raised over 13.3 million Birr from the sale of 133,477 unpaid shares in a weeklong public auction.[69] It is clear that the market is far ahead of the legislators and regulators, and it exists informally irrespective of the position held by the government.[70] The auctioning of shares may be a good approach for testing the market value of shares alongside raising capital.[71]

Although the collective insight of the bidders may determine the market value of shares, investors need to be cautious when picking a share from an unlisted share company.[72] They must carefully weigh-up all the available information, such as, financial statements of the bank including the Return on Capital, and estimate the earnings potential and dividend prospects.[73] As other banks may follow suit and try to sell their unpaid shares, authorities, such as the NBE, should pressure public companies to provide relevant information and investment guidance to bidders.[74]

Establishing an organized share market, and furnishing it with a robust legislative framework could help the state enhance its ability to generate revenues, create additional employment and help establish several businesses that could support the market.[75] To the share buying public, such an institutional framework also enhances confidence in the industry and make the business of buying and selling shares easier, profitable, and predictable.[76]

3.2. Mix of Politics and Business

The existence of endowment companies owned and controlled by political parties is one of the controversial aspects of the investment climate in Ethiopia.[77] Endowment companies are allowed to own enterprises that compete with the private sector, although it is unclear how the initial capital of these companies was paid.[78] To date these companies are presented as if they are regional development organizations and each federal region is supposed to have at least one endowment company holding various enterprises that operate factories, banks, insurance companies, and other business activities.[79]

At present, there are four endowments under the umbrella of the EPRDF. These are: EFFORT (for the rehabilitation of Tigray region), Endeavour (for rehabilitation of Amhara region), Dinsho (focused on rehabilitation of Oromia Region), and Wondo-Trading (for rehabilitation of Southern region).[80] EFFORT (The Endowment Fund for the Rehabilitation of Tigray) is a multi-billion dollars business conglomerate, which holds over eighty portfolio companies under it.[81] In the financial sector, EFFORT is the sole shareholder of EPRDF controlled Wegagen Bank.[82]

In addition to this, three new parties owned banks were also established recently including, Abay Bank, Lion International Bank, and Debub Global Bank.[83] Lion International Bank is composed of top party affiliated individuals, such as, Sebehat Nega (founder of the TPLF), and General Samora Yenus (Chief staff of the National Army). Abay Bank chair Tadesse Kassa (a member of the executive committee of the EPRDF); major shareholders include companies under Endeavour endowment.[84] Super patrons of Debub Global Bank include Shiferaw Shigute (President of Southern regional state).[85]

From the perspective of efficient competition, TPLF being the ruling party in the present Ethiopian government creates suspicion concerning the equal treatment of EFFORT-companies and other non-party-related private companies.[86] Given the blending of politics and business, it is highly probable that business decisions are being made solely on political justification rather than sound business principles. Hence, in the absence of a conducive and reliable business environment, the growth of the private sector based on competition and vigorous market principles is futile.

3.3. Inadequate Shareholder Protection Laws

The highest power of shareholders is their voting rights and they exercise such rights on major corporate issues, such as, in the election and removal of directors, share in profits etc.[87] This section attempts to examine shareholder rights in the Ethiopian corporate law in light of voting rights attached to shares, rights against interference by the insiders during voting, and remedial rights against abuse.[88]

Investors may be better protected when dividend rights are tightly linked to voting rights, which is called one share-one-vote rule system.[89] When votes are tied to dividends, corporate administrators cannot have substantial control of the company without having substantial ownership of its cash flows.[90] The one-share-one-vote principle may comprise non-voting shares, low and high-voting shares, or restriction on the number of votes to be exercised at a shareholders’ meeting.[91] There is a real one-share-one- vote system in a country if none these practices are allowed.[92]

Examination of the provisions of the Com C shows how dividend rights are tightly linked to voting rights. Art 335-337 of the Code provides for the different classes of shares, dividend shares, and preference shares. Art 337 (1) and (2) outline that a company may repay to shareholders the par value of their shares and such dividend shares give voting rights.[93] However, Art 408 of the Code allows a limitation on the number of votes that shareholders may exercise at a meeting. This example illustrates the absence of genuine one-share one-vote rule in Ethiopia.

The procedures of exercising voting rights have an impact on the protection of shareholders’ rights. Such procedures include appearing in person, sending an authorized representative, or mailing proxy vote directly to the firm.[94] The Com C under Art 398 (1) and Art 402 specifies voting by a duly appointed representative, but not voting by mail. The importance of voting in absentia including electronic voting is emphasised by the OECD Principles of Corporate Governance.[95] Likewise, Art 401 of the Code provides for depositing shares with the company prior to shareholders meetings, but this keeps shareholders, who do not bother to go through this process, from voting.[96] Hence, voting procedures stipulated under the Code constrains shareholders from effectively exercising their rights.

Cumulative voting and proportional representation on the board are alternative shareholder protection mechanisms that give more power for minority shareholders to put their representatives on boards of directors.[97] Art 352 of the Code provides, “shareholders with a different legal status have a right to elect at least one representative in the board of directors.” The provision is insufficiently clear, for example, what is meant by “legal status”? Is the law referring to the class of shareholders from Art 335 to Art 337? It seems to require a situation where shareholders are divided into several groups with each shareholder identified in its group and vote accordingly. However, this cannot work in share companies with thousands of shareholders.[98] Thus, in the absence of a clear provision that can readily be implemented, the provision gives little protection for shareholders.

Similarly, derivative suit mechanisms give protection for shareholders’ right by providing a buffer against perceived oppression by directors, through challenging a directors’ decision in court.[99] Though the Com C fails to set out the right under Art 365(1), it appears that the drafter of the provisions (Escarra) had initially drafted the provisions from Article 364-367 with the aim of providing for derivative suit mechanisms.[100] He stated in his Exposé des Motifs the importance of the provisions to regulate the liability of directors, and the procedure for enforcing this liability by individual or class action.[101] Nevertheless, the effective use of this provision by shareholders is doubtful considering the rare and inefficient applicability of the Code by courts.[102]

3.4. Ineffective Court System

Within the three branches of the Ethiopian government, the Judiciary has a short history of independence.[103] There is evidence which shows that the Executive routinely intervenes on the operations of courts.[104] The court drama in respect of the ex-defence Minister, the leaders of the main opposition party, and the firing of the two auditor generals by the Executive, were events that tarnished the image of the Ethiopian court system.[105]

Although the independence of the Judiciary from the influence of both the Legislature and Executive is enshrined in the Constitution, independence remains functionally constrained.[106] Given the overwhelming dominance of the ruling party, the Judiciary operates in an atmosphere where political influence is unmistakable.[107] These problems are compounded by the widespread lack of awareness of the principles of judicial independence amongst people and administrators alike.[108]

Bottlenecks and incompetence in the court system have been a focus of criticism.[109] Courts do not yet represent a reliable recourse for those whose legal rights have been infringed.[110] It takes multiple steps and protracted period to enforce commercial contracts in Ethiopia.[111] This inhibits the growth of investments, since legal safeguards do not protect businesses.[112] Moreover, the large role of the government in the economy subject courts to government interference on commercial matters involving government enterprises.[113] Thus, since the challenges facing the justice sector are complex and deep-rooted, it requires significant strengthening to obtain true independence.[114]

4. Bank Regulation in Ethiopia: the Regulatory Power of the National Bank

The National Bank of Ethiopia (NBE) as the country’s central bank was first established in 1963. On May 1991, a new Monetary and Banking Proclamation No.83/1994 was enacted which reorganized the bank according to the market-based economic policy so that it could foster monetary stability, a sound financial system and such other credit and exchange conditions conducive to the growth of the country’s economy.[115]

Implementing good corporate governance practices in the banking sector clearly facilitates the NBE’s most important goal of fostering monetary stability and a sound financial system in the country. Thus, to enhance the achievement of such goals, the legislator has empowered it with various powers, such as, the power to prescribe the requirements for eligibility of bank directors, managers, and to reject the appointment of those nominees who do not satisfy its criteria; to ensure that banks have prepared and publicized proper financial statements and they are adequately disclosed to the public; to regulate transactions that could give rise to possible conflict of interest; to regulate the rights of shareholders and the amount of shareholdings they can hold in a bank, and to regulate risk management in banks. Moreover, in order to give teeth to the powers of the NBE, the law has empowered it to supervise compliance of rules by banks through onsite and off-site supervision mechanisms and to impose various sanctions on a non-complying bank.

2.1.1 Regulating Rights of Shareholders

Shareholders have certain basic rights that the NBE is expected to protect by various means, such as by issuing directives, by taking corrective supervisory measures etc. Art 345 of the Com C provides the different rights arising out of shares including the right to participate in the annual net profits, sharing in the net proceeds on a winding up, preferential right to the allotment of new shares issued etc. Art 350 and Art 351 of the Code provide a right to elect and remove members of the board; Art 353 and Art 419(2) prescribes the right of shareholders to fix remuneration of directors. These are some of the rights, which ensures shareholders’ participation in important corporate governance decisions, so any derogation may entail penalty via the NBE.

Regarding equal treatment of shareholders and protection of minority shareholders, the NBE has a duty of ensuring the equal treatment of shareholders and the protection of rights of minorities. Although the Com C under Art 335 and Art 352 envisaged the equal treatment and protection of minority shareholders, these provisions seem inadequate and are found in a fragmented manner.

4.1. Regulating Transparency and Disclosure

The corporate governance framework should ensure that timely and accurate disclosure is made on all-important matters regarding the corporation, including the financial situation, performance, ownership and governance of the company.[116] To maintain an efficient governance system in the banking sector, establishing sound disclosure and transparency requirements by NBE is worthwhile. Accordingly, each commercial bank in Ethiopia is duty bound, with in one month from the closing of each financial year, to send to the NBE a duly signed balance sheet; profit and loss statement.[117]

At the same time each bank has a duty to disclose a copy of its financial statement in each area of its business through out the year and publish it in a daily newspaper circulating in Ethiopia.[118] The practice is far from the law as no bank discloses such information at its place of business and it is not issued in any daily newspaper in Ethiopia.[119] Hence, disclosure and transparency, which is a central facet of corporate governance is at a rudimentary stage in Ethiopia.

Disclosure of the names and voting rights of shareholders to the public with out charge at the bank’s head office is mandatorily required, although it is not practically observed.[120] Similarly, important information about the CEO and the Director of a bank such as their age, marital status, education, and their employment history needs to be disclosed in advance of their selection and approval by the NBE.[121] From these criteria we can understand that NBE seems to have appropriate legal frameworks in regulating disclosure of information in the banking sector.

With regarding to annual auditing, it is the responsibility of the NBE to ascertain every bank has appointed independent auditors who review the existing policies, processes and controls with in the bank and report audit findings to the shareholders.[122] If NBE is not satisfied with the external auditors’ report, it may oblige such bank to commission second audit or require the prompt appointment of new auditors.[123] Hence, the appointment of independent auditors may also be a prerequisite for the NBE to accept or reject an annual audit report.

4.2. Regulating Board Rights and Duties, and Risk Management

One of the key regulatory functions of the NBE is overseeing whether or not the appointment, rights and duties of the Board conform to the principles and requirements of the relevant legislations.[124] NBE approves the appointment of directors of a bank based on a complete propriety test questionnaire and other relevant documents submitted to it.[125] Such criteria include holding a minimum of first degree, having adequate managerial experience in banking business, and being a person with honesty, integrity, and diligence.[126]

NBE also oversees the selection criteria and appointment of CEO of a bank by the board. NBE approves the appointment of a CEO following the same procedure as the appointment of directors. To be eligible a candidate is expected to demonstrate competence and an ability to understand the technical requirements of banking business, inherent risks and management processes required to conduct banking operations effectively, and simultaneously meet the fit and propriety test.[127] In addition, the candidate must fulfil the age, marital status, educational, and employment criteria.[128]

With regard to the appointment of a CEO of banks, NBE tends to apply relaxed procedures for state banks and strict procedures for private banks.[129] NBE approved the appointments to the top most position in the Ethiopian Commercial Bank (CBE) despite shortfalls in meeting its own criteria, whereas it made a private bank’s new President wait for two years to meet the legal requirements.[130] Obviously, such kind of discriminatory practice creates uncertainty on NBE’s regulatory functions.

Concerning risk management, NBE has to supervise each commercial bank to see that it has its own comprehensive risk management polices, strategies and guidelines, and ensure that adequate steps are taken to avert or control all important risks.[131] NBE has a duty to determine the minimum amount of capital and reserves maintained by banks depending on their risk profile.[132] NBE requires banks to keep a special reserve account for loss arising from negligence and dishonesty of a director or an employee.[133] All these provisions enhance the NBE’s role of risk management in the banking sector.

5. Corporate Governance and Private Banks in Ethiopia

After the country adopted market economic policies in 1991, a series of financial sector reforms were introduced, and a number of private banks and insurance companies had permission to be re-established.[134] Proclamation No. 84/94 outlined the deregulation and liberalization of the financial sector, and laid down the legal basis for investment in the banking sector. Consequently, between 1994 and 1998, five private banks were established, Awash International Bank being the pioneer.[135] Hitherto, there are sixteen banks operating in the country of which thirteen are private commercial banks.[136]

The above-mentioned five banks are selected for this study as they have been operating for more than ten years in the banking industry.[137] Moreover, the selection has also taken into consideration some special features, i.e. Wegagen Bank represents politically affiliated party bank and Dashen Bank represents family bank.[138]

Critics argue that the financial sector reform has not gone far enough. One of the contentious issues is the absence of foreign banks in the industry.[139] Foreign banks will increase competition in the banking sector and lead to improvements in service delivery by the domestic banks.[140] Moreover, the three large state-owned banks continue dominating the market in capital, deposits and assets.[141] Bank concentration, defined as the asset share of the three largest banks, is 87.9 percent, which indicates an absence of competition in the banking sector.[142]

Studies have found a positive relationship between financial sector openness and economic growth, so the entry of foreign banks would have significant positive effects on the Ethiopian economy.[143] However, foreign ownership of domestic banks is often mentioned as one source of financial instability.[144] The global financial crisis does not have a direct effect on Ethiopian financial institutions as foreign banks do not have branches in Ethiopia.[145] Opening Ethiopia’s financial sector to foreign banks would require improving the undeveloped financial infrastructure.[146] Until the financial sector infrastructure is strengthened the government’s stance against foreign banks seems realistic.

5.1 Corporate Governance Mechanisms and Bank Performance

This section explores the impact of corporate governance mechanisms on the performance of private banks. Among a wide range of corporate governance mechanisms only ownership structure (concentrated or diffused ownership and stock ownership by managers and directors), and board structure (in terms of size, composition, CEO duality) are the focus of this section. These two governance mechanisms are emphasized in view of their relatively higher impact on the exercise of shareholders controlling rights.

Ownership structure

The relationship between ownership structure and firm performance has been the subject of an on going debate in the corporate finance literature.[147] There is no conclusive finding on the systematic relationship between ownership structure and firm value. The debate goes back to Berle and Means who argued that there is an inverse correlation between diffuse ownership structure and firm performance.[148] They point out the potential agency problems associated with the separation of management and ownership in the firm.[149]

Concentrated ownership may mitigate the agency problem arising from diffused ownership.[150] Shareholders owning large amount of stock are more motivated to monitor managers than shareholders holding a tiny fraction of shares.[151] Conversely, despite its role in improving governance of firms, concentrated ownership has drawbacks. Large shareholders can collude with managers to expropriate small investors’ benefits in the firm, which is called ‘tunnelling’.[152] Hence, Shleifer and Vishny argue that a good corporate governance system should combine ownership concentration with legal protection of small investors.[153]

When we look at ownership pattern in the Ethiopian banking sector, Art 27(1) of Proclamation No. 84/1994 provides a maximum shareholding limit of twenty percent. However, this amount is slashed to five percent by the new Banking Business Proclamation No.592/2008. Hence, with the enactment of the new proclamation there is a trend towards diffused ownership.[154] Moreover, Art 2(11) of the proclamation defines a shareholder who owns two or more of the total subscribed capital as an influential shareholder.[155] Art 10(3) of the proclamation also states that a share transfer that will make a person an influential shareholder be approved by the NBE.

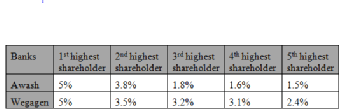

Table.1: Summary of Influential Shareholders (Source: from the Banks’ Finance Department (2010))

The above table shows that there are very few influential shareholders in Awash Bank and large number of influential shareholders in Wegagen Bank, thus these investors can clearly influence the governance system of the latter bank because of their relatively high ownership positions.[156]

Concerning managers’ and directors’ shareholdings, the Code stipulates under Art 347(1) and Art 349 that a person to be a director must be a shareholder. During the first years of its operation, Dashen Bank was giving shares to managers to motivate them to work for the bank’s success.[157] Share holding by directors and managers can be a good mechanism to minimize agency problems.[158] However, the current turmoil in financial institutions relates to incentive systems (in the form of salary, bonus, stock options, pensions and perquisites) that do not reflect the strategy and risk appetite of the company and its longer-term interests.[159] The Walker Review recommends that remuneration should be on a long-term incentive basis with vesting, subject to performance conditions, deferred for up to five years.[160]

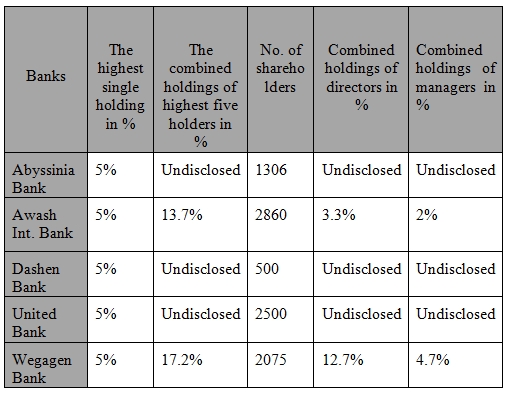

Table. 2. Ownership Pattern of the Five Private Banks (Source: from the banks’ finance department (2010))

Evidence form the above data illustrates a wide divergence in the ownership pattern of the two banks since Wegagen Bank has a large combined ownership percentage of the top five shareholders in contrast to Awash Bank. Moreover, the combined ownership of directors and managers is also higher for Wegagen Bank.

At this juncture a very important question is, whether diffused ownership is the appropriate ownership style for Ethiopian private banks?

In order to be an efficient corporate governance mechanism, diffused ownership need to be accompanied by strong legal protection of minority rights.[161] A legal regime which allows investors to feel confident about owning a tiny percentage of shares in a firm constitutes the crucial “bed rock” that underpins a widely dispersed share ownership.[162] However, as discussed under section two, i.e. limitation on voting rights, prohibiting voting by mail, deposition of shares before voting, absence of remedy against abuse by directors, and the ineffective court system signify poor shareholder protection in Ethiopia.

Moreover, strong securities markets, rigorous disclosure standards, and high market transparency in which the market constitutes the ultimate disciplinary mechanism on management characterize diffused ownership.[163] As it has already been pointed out, all of these are absent in Ethiopia.[164] All these suggest that diffused ownership may not seem the suitable ownership model. Thus, there should be concentrated ownership complemented by an adequate legal framework to give protection for minority rights and to prevent undue shareholder interference in the activities of bank administrators.[165]

Board Structure

The structure of a board can be explained in terms of its characteristics such as composition, size, and CEO duality.[166] Board structure has a possible impact on corporate performance since it might affect the directors’ motivation and their ability to effectively monitor and advise managers.[167]

Board composition refers to the number of independent Non-Executive Directors (here after NED) on the board relative to the total number of directors.[168] An appropriate composition of directors, who are capable of exercising judgment independent of the views of management, political interests, business, family or other inappropriate outside interests, enhances the independence of the board.[169]

There is an apparent presumption that boards with a significant number of outside directors will make different and perhaps better decisions than boards dominated by insiders.[170] NED reviews the performance of the board and management objectively[171]; bring new perspectives from other businesses; advance the company’s reputation, and assist the creation of business affiliations.[172] In addition, they can play an important role in areas where the interests of management and the wider interest of the company may diverge such as executive remuneration, succession planning, take-over, and the audit function.[173] Furthermore, the composition of board committees has a profound impact on its effectiveness[174]; therefore it is recommended that audit committee should consist only of outside directors while remuneration and nomination committees should consist of a majority of out side directors.[175]

Nevertheless, in light of the global financial crisis the Walker Review states that the principal deficiencies in bank boards related much more to patterns of behaviour than to organization or composition.[176] It recommends that there should be a knowledgeable and competent group of independent NEDs capable of questioning and challenging the decisions of the executives.[177] The presence of NEDs who focus more on diffidence, politeness or courtesy at the expense of truth and frankness is meaningless.[178] This necessitates a substantial change in board culture so that rigorous, but constructive challenge on substantive issues comes to be seen as the norm.[179]

Concerning board composition, Art 14(4) (f) of the Banking Business Proclamation authorized NBE to determine the maximum number of executive directors. So far, however, there is no directive issued by NBE that dictate how many outside directors should serve on a bank’s board. Thus, each bank can structure the composition of the board in a way that promotes its own firm value.

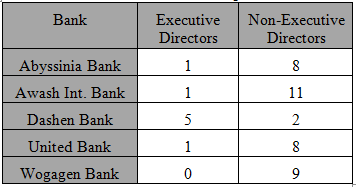

Table.3. Board Composition

The above table shows that except for Dashen bank, all banks have an overwhelming majority of out side directors. A higher number of outside directors, who effectively challenge the executive, enhance the performance of a bank. However, all directors should not be outside directors, since inside directors are more familiar with the firm’s activities, they could facilitate the flow of information to the outsiders.[180] Thus, there should be a trade off between the advantages and disadvantages in the proportion of NEDs.[181]

With respect to board size, the capacity of the board for monitoring increases as its number increases since a larger board brings more human capital.[182] Large boards could also provide the diversity that would help companies to secure critical resources like access to markets, new and better technologies that enables the board to provide management with high quality advice.[183] However, the consensus in finance literature is that large board size will have a negative effect on firm performance as coordination; communication and decision-making problems increasingly impede firm performance when the number of directors increases.[184] So, the size of a board is a compromise between costs and benefits.[185]

In connection with this, the Walker Review supports the view in finance literature.[186] The general opinion would probably tend to suggest an “ideal” size of 10-12 members.[187] In practice, however, decisions on board size will depend on the nature and scope of the business of a firm, its organizational structure and leadership style.[188] So there can be no general prescription as to optimum board size.

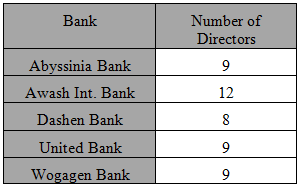

Table 4. Size of the Board

The above table displays that the size of the board in the five banks is within the range suggested by finance literature. As shown in the table, the maximum board size is twelve. Concerning board size, the Com C provides under Art 347 (2) that a company must have at least five directors but no more than twelve directors.

Another area of concern in board structure is CEO-chairman duality. The objectivity of the Board and its independence may be strengthened by the separation of the role of Chief Executive and Chairman.[189] Research indicates that CEO-chairman duality is detrimental to companies, as the same person will examine his/her own work.[190] Separating the titles of chairman and CEO may be regarded as good practice and it will reduce agency costs and improve firm performance.[191] It increases the accountability of CEO, and improves the Board’s capacity for decision-making independent of management.[192] Alternatively, if these roles are combined, designating a lead non-executive director to convene or chair sessions of the outside directors may curb the problem of CEO duality.[193]

Contrary to the aforementioned view, the Walker Review maintains the perspective that there should be flexibility on CEO duality.[194] It noted that where such an appointment is made, a clear justification should be made.[195] With regard to CEO duality proclamation No 592/2008 under Art 15(4), and NBE directive No.39/2006 clearly prescribe separation of the two posts, and all the five sample banks showed the same.

Conclusions

This article has attempted to consider the overall climate of corporate governance in the Ethiopian banking sector through the lens of principles of good corporate governance. The issue of corporate governance in the banking sector stands out as one of the problematic areas. The blending of politics and business, absence of share markets, inadequate shareholder protection laws, and an ineffective court system are the defining elements of the Ethiopian banking sector.[196] Moreover, a poor competitive environment characterizes the banking system.[197]

Active involvement of political parties in business through endowment companies, which were originally intended to conduct non-trade development activities, creates a gloomy condition for the growth of the private sector since party affiliated companies enjoy competitive advantages over private companies.[198] The absence of an organized and well-regulated share market makes valuation and price discovery of banks problematic and thereby inhibits share markets from being sound corporate governance mechanisms.[199] In adequate shareholder protection laws and the ineffective court system affects investor confidence and discourages investors to put their capital in business.[200]

As far as the poor competitive environment is concerned, banks can offer higher interest rate to attract customers provided it is not below the minimum rate set by NBE.[201] However, there is no competition among private banks since they merely follow interest rate fixed by CBE. Unfortunately, this has helped private banks to carve out the market among them, and make exorbitant profits year after year in the absence of proper and strong corporate governance.[202] In this regard, NBE should be responsible to draw up a code whereby the sector could compete in a fair and balanced environment.[203]

The landscape of the Ethiopian financial sector is also characterized by the prohibition of foreign banks and the dominance of state owned banks.[204] The giant of the sector is the government-owned CBE, which is the largest bank in the industry, accounting for nearly half of the branch networks, over 60% of the outstanding loans and about 70% of the deposits of the commercial banks.[205] Foreigners may not own shares in Ethiopian banks, which policy-makers hope will boost the local private sector.[206] Though financial sector openness contributes to economic growth, it may also expose the financial system of the country to external shocks and crises.[207] Hence, given the present weak regulatory capacity of NBE the government’s stand against foreign banks makes some sense.

The private banking system in Ethiopia is characterized by an inadequate risk management system. The risk management problems manifest themselves in the number of foreclosures in recent times.[208] Before a loan is declared in default, the bank takes various steps to save it, and if the number of cases foreclosing is high, it means there is a serious risk management problem.[209] So, international standards and codes of best practice, which could strengthen domestic institutions, enhance a country’s resilience to shocks and better support its risk assessment and investment decisions, need to be adopted in the Ethiopian corporate sector.

Corporate governance can affect corporate performance.[210] Insider ownership (ownership by managers and board members) is preferable to outsiders managing the firm; a board filled with an atmosphere of challenge; sound risk management systems, and a competitive environment among banks, are governance mechanisms that enhance financial value of banks. The relevant literature and empirical research on the interaction between corporate governance mechanisms and financial performance in general have mixed results.[211]

The strength and performance of the financial sector of a nation is an indicator of the strength of the economy.[212] Good corporate governance contributes to the efficient mobilization and allocation of capital, the efficient monitoring of corporate assets; and improved national economic performance.[213] Considering the existing flaws in the Ethiopian bank corporate governance, this article suggests that there is a need for adequate reform and adoption of good corporate governance principles discussed in this work.

There is a need to establish a strong and well-regulated share market since capital markets are a major source of finance for the financial sector and play a great role in mobilizing domestic resources as well as attracting foreign direct investment.[214] As capital markets set the market value of listed companies on an on going basis, they force the banking system to become more competitive.[215] Adequate legal rules and efficient law enforcement mechanisms, that protect shareholders from expropriation, are essential in creating a climate of trust and confidence that encourages individuals to invest in companies.[216] Cutting off political parties’ engagement in business enterprises requires reform in all aspects of governance including political, institutional and legal. All these should be addressed simultaneously. To rectify the problems in the regulatory body (NBE), this study recommends adoption of the three main components of good regulatory governance, namely: independence, accountability and transparency.[217]

However, establishing standards of corporate governance cannot be achieved by structures and rules alone.[218] These are important in providing a framework, which will encourage and support good governance, but what counts is the way in which they are implemented.[219] Realizing those standards lies directly with the board of directors of each bank, as well as, the regulatory body to whom the proclamation and the commercial code is addressed.

References

[1] Spong, K, R, and Sullivan, R, J. 2007. Corporate Governance and Bank Performance. Journal of Economics Literature No. G21, G34, p.1; see also Tandelilin, E, Kaaro, H, and Mahadwartha, P.2007.Corporate Governance, Risk Management, and Bank Performance: Does Type of Ownership Matter? EADN Working Paper No. 34, p.2.

[2] Agoraki, Maria-Eleni, Delis, and et al.2009.The effect of board size and composition on bank efficiency, p.4; see also Levine, R.2003.The Corporate Governance of Banks: A Concise Discussion of Concepts and Evidence, the Global Corporate Governance Forum Discussion paper No.3, p.3.

[3] Spong, K, R, and Sullivan, R, J. Supra Note 1; Salehi, M.2008.Corporate Governance and Audit Independence: Empirical Evidence of Iranian Bankers. International journal of Business Management,3 (12),p.44.

[5] Guidelines for Enhancing Good Economic and Corporate Governance in Africa, Economic Commission for Africa, May 2002,p.5; Enhancing Corporate Governance for Banking Organizations, Basel Committee on Banking Supervision, 31 October 2005,p.4&5.

[6] Ungureanu,M, and Cocris,V. 2008. Northern Rock: the Crisis of a UK Mortgage Lender. JEL classification: G14; G21; G33,pp.154-162; Bollard, A. Corporate Governance in the Financial Sector, the Annual Meeting of the Institute of Directors in New Zealand, Christchurch, 7 April 2003,p.2.

[7] Kanas,A. 2005. Pure Contagion Effects in international Banking: the Case of BCCI’s Failure. Journal of Applied Economics,8(1),pp.101-123; Negash, M. 2008. Rethinking Corporate Governance in Ethiopia, Journal of Economics Literature classification: K12, K22, L22, M14, M41, N27,p.4 ; Westman, H.2010The role of ownership structure and regulatory environment in bank corporate governance. Journal of Economics Literature classification: G21, G28, G32, G38, p.1.

[8] Bollard, A. Supra Note 6,p.3 Other International Principles of Corporate Governance include Committee on Corporate Governance (The Hampel Report) January 1998; Suggestions for Good Practice from the Higgs Report, Financial Reporting Council, June 2006; King Report on Corporate Governance for South Africa, Cliffe Dekker Attorneys, 2002. www.cliffedekker.com;Sarbanes-Oxley Act of 2002, Public Company Accounting Reform and Investor Protection. http://www.frwebgate.access.gpo.gov/cgi-bin/getdoc.cgi

[9] Report of the Committee on the Financial Aspects of Corporate Governance (the Cadbury Report), December 1, 1992; Enhancing Corporate Governance for Banking Organizations, Basel Committee on Banking Supervision, 31 October 2005; Organization for Economic Cooperation and Development (OECD) Principles of Corporate Governance, 2004.

[10] Reforming Public Institutions and Strengthening Governance: A World Bank Strategy, Public Sector Board Poverty Reduction and Economic Management Network September, 2000,pp.1-212.

[11] The writer had visited the National Bank of Ethiopia (NBE) and the five private banks to get some information about the operation of private banks and the NBE private banks inspection report, her request was vehemently denied by the NBE’s as well as the private banks’ officials although she showed a letter evidencing use of the requested data for research purpose. On top of all these problems few of the officials who showed cooperation gave the writer persistent warning not to include such information in her study. Generally, even though the Banking Business proclamation 592/2008 requires all banks to disclose the name and voting rights of shareholders, this is not clearly what the practice portrays.

[12] John,K, and Senbet,L.1998.Corporate Governance and Board Effectiveness. Journal of Banking and Finance, 22,p. 372; Standard and Poor’s Corporate Governance Scores – Criteria, Methodology and Definitions, 2002, http://www.governance.standardandpoors.com; Zingales, L.1997.Corporate Governance. JEL No. G3, the New Palgrave Dictionary of Economics and the Law,p.3.

[13] Shleifer,A, and Vishny, R, W.1997.A Survey of Corporate Governance. The Journal of Finance,52(2),p.737.

[14] Salehi, M.2008.Corporate Governance and Audit Independence: Empirical Evidence of Iranian Bankers. International journal of Business Management,3(12),p.45.

[15] OECD Principles of Corporate Governance, 2004, p.11.

[16] Waweru, N, M, Kamau, R, G. and Uliana, E.2008. Audit Committees and Corporate Governance in a Developing Country. Journal of Economic Literature Classifications: M49, M41, M47, G34, G38, G15, C99,p. 6.

[17] Arun, T, G, and Turner, J, (eds). 2009. Corporate Governance of Banks in Developing Economies: Concepts and Issues. Corporate Governance and Development, p.97.

[18] Levine, R.2003.The Corporate Governance of Banks: A Concise Discussion of Concepts and Evidence, the Global Corporate Governance Forum Discussion paper No.3,p.2-3.

[19] Andres, P and, Vallelado,E. 2008. Corporate Governance in Banking: the Role of Board of Directors. Journal of Banking and Finance,32,P.2571.

[23] Agoraki, Maria-Eleni, Delis, and et al. Supra Note 2.

[26] Improving Corporate Governance and Transparency in Banks and Insurance Companies in Kosova, April 2009,p.9.

[28] Levine, R. Supra Note 22,p.4-5 Further more, they are also more effective at exercising their voting rights than small comparatively uninformed shareholders.

[33] Arun, T, G, and Turner, J. Supra Note 17, p.97-98.

[34] Westman, H. Supra Note 7.

[36] Agoraki, Maria-Eleni, Delis, Supra Note 23,p.4; see also Westman, H. Supra Note 33,p.1.

A bank with grate loan loss provisions takes high risk projects when the government provides a generous deposit insurance system and also banking crisis is more common in countries with generous deposit insurance system.

[37] Arun, T, G, and Turner, J. Supra Note 33,p.98.

These regulations limit the ability of bank managers to over-issue liabilities or divert assets in to high risk ventures.

[38] Heath, J, and Norman, W.2004.Stakeholder Theory, Corporate Governance and Public Management: What can the history of state-run enterprises teach us in the post-Enron era? Journal of Business Ethics, 53,p.252.

Shleifer, A, and Vishny, R, W. Supra Note 13, p.741, state that the financers and the manager sign a contract that specifies what the manager does with the funds, and how the returns are divided between the manager and the financers.

[40] Alexander, K, and Duhmale, R. 2001. Enhancing Corporate Governance for Financial Institutions: the Role of International Standards, University of Cambridge Working Paper No.196, P.5-6; Jensen, M, C, and Meckling, W, H. 1976. Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4),p.5-7.

[41] Shleifer, A and Vishny, R, W. Supra Note 13,p.742.

[42] Arun, T, G, and Turner, J. Supra Note 37,p.97- 98.

[45] Tandelilin, E, Kaaro, H, and Mahadwartha, P.2007.Corporate Governance, Risk Management, and Bank Performance: Does Type of Ownership Matter? EADN Working Paper No. 34, p.11.

[46] Alexander, K, and Duhmale, R. Supra Note 40.

[48] Spong, K, R and Sullivan, R, J. Supra Note 3,p.22; Shleifer, A and Vishny, R, W. Supra Note 40, p.742-743, suggest that Ownership stake for hired managers can help to align the interests of managers more closely with that of stockholders as it gives them an incentive to maximize firm value. Nevertheless, further increases in ownership may result entrenchment since managers may staying on the job although they are no longer competent to run the firm and this is considered as the gravest effects of the agency problem.

[50] Heath, J, and Norman, W. Supra Note 38,p.8.

[53] Heath, J, and Norman, W. Supra Note 50,p.9.

[55] Negash, M. 2008. Supra Note 7, p.4-5.

[56] Tessema, A.2003. Prospects and Challenges for Developing Securities Market in Ethiopia: An Analytical Review. R & D Management, 15(1), p.51. Ethiopia is still a relatively under-banked country with one bank per six million people. With branches often not networked and facilities such as electronic payment and internet banking in their infancy, there is still plenty of room for improvement of customer service.

[57] Negash, M. 2008. Supra Note 55.

[58] Tessema, A.2003. Supra Note56,p.50.

[61] Negash, M.2008. Supra Note 57, p.5.

[63] Editor’s Note. Putting the Wagen before the Horse. 2010. Fortune, 23 August, p.5;

Tessema, A.2003. Supra Note 58,p.51.

[65] Tessema, A. Supra Note 58,p.52.

[67] Editor’s Note. Supra Note 63.

[69] Sahle, E. United Shares Worth 60pc More than Initial Offerings.2010. Fortune, September 14,p.2

[70] Editor’s Note. Supra Note 67.

[71] Assefa, A. Strong Economy, High Returns No Guarantee for Future Share Values. 2010. Fortune,14 November, p.4.

[77] Toward the Competitive Frontier: Strategies for Improving Ethiopia‘s Investment Climate, Document of the World Bank, Report No. 48472-ET, June 2009,p.54.

[78] Milkias, P. Ethiopia, TPLF and Roots of the 2001 Political Tremor, A paper presented to” the Proceedings of the International Conference on Contemporary Development Issues in Ethiopia,” Ethiopian American Foundation, Western Michigan University, Aug. 18, 2001,p.18.

[79] Supra Note 77, p.55; Negash, M. 2008.Supra Note 61,p.7.

[80] Ibid, p.55; See also Milkias, P. Supra Note 78,p.17.

[81] Ibid. Some of the companies under EFFORT are: Wegagen Bank, Mesebo Building Materials Construction, Sheba Tannery, Almeda Textile, Addis Pharmaceuticals, Mesfin Industrial Engineering, Meskerem Investment, Ezana Mining, Africa Insurance, Guna Trading, Addis Consultancy House, SUR Construction, Trans-Ethiopia, Hiwot Mechanisation, Tesfa Livestock, Rahwa Goat and Sheep Export.

[82] Milkias, P. Supra Note 80,p.18

In an interview held with secretary of the board of Wegagen Bank, the secretary indicated that the board of the bank includes influential political individuals like Ato Sebehat Nega who is the founder of TPLF.

[83] Yewondwossen, M. NBE Green Lights Abay, and Debub Global Bank. 2010. Capital, 4 July, p. 4.

[84] Ibid. Endeavour Endowment owns some large firms, notably Dashen Beer, Ambasel Trading, and Tikur Abay Transport.

[86] Supra Note 77, p.55; Mersha,G, Increased Role of Party-Owned Enterprises and the Economy Raises Several Serious Concerns,p.2. The growing role of politically affiliated non-private, and non-bona fide businesses created unhealthy environment in the Ethiopian corporate sector. www.tecolahagos.com/INCREASING%20ROLE%20OF%20PARTY.

[87] La porta, R, Lopez-de-Silanes, F, Shleifer, A, and Vishny, R, W.1998. Law and Finance. Journal of Political Economy,106(6),p. 1126.

[91] Ibid,p.1127. Other types of one-share-one vote principles are: shares with extremely high voting rights, or shares whose votes increase when they are held longer.

[93] It is important to note here that the different class of shares envisaged under Art 335 is repealed by Art 10 of Proclamation No. 592/2008 which states that bank shares shall be of one class and shall be registered as ordinary shares of the same par value.

[94] La porta, R etal. Supra Note 87, p.1127; OECD Principles of Corporate Governance, 2004,p42. Part II, C.4 provides the right of proxy voting, Part III. A.5 broadly states the importance of making exercise of voting rights in general meetings simple. It disapproves preconditions to exercise voting rights, which obviously includes conditions such as depositing shares during general meetings. The annotations to the Principles state cumulative voting, pre-emptive right to purchase newly issued shares, derivative suit mechanisms.

[95] OECD Principles of Corporate Governance, 2004, p.35.

[96] Supra Note 94. The requirement of depositing shares obviously keeps shareholders, who do not bother to go through this process, from effectively exercising their rights.

[97] OECD Principles of Corporate Governance, 2004, p.42;La porta, R etal. Supra Note 94.

Cumulative voting relates to voting during board elections in which the votes of the contending groups will be multiplied by the number of board seats and calculated for the contenders’ nominees in accordance to the proportion of each group’s summed up votes. This essentially avoids a majority-take-all outcome.

[98] Bank Presidents Coining IT IN. 2010. [online]. [Accessed 18 December 2010]. Available from World Wide Web: http:// www.addisfortune.com/BANK%20PRESIDENTS%20COINING%IT%IN-2.htm. The recently established Buna International has around 11,500 shareholders.

[99] La porta,R etal. Supra Note 97,p.1128.

[100] Winship, P. 1974. Background Documents of the Ethiopian Commercial Code of 1960, Addis Ababa, Faculty of Law, Haile Sellassie I University, p.64

Up on the sudden death of Escarra, it is more probable that the original drafted rules were later changed either by Jauferet who replaced him, or by the Codification Commission.

[103] BASES Wiki. 2010. [online]. [Accessed 4th December 2010]. Available from World Wide Web:<http://wwwbaseswiki.org/en/Ethiopia

[104] Negash, M.2008. Supra Note 61,p.8.

[106] BASES Wiki, Supra Note 103.

[108] Ibid. A long history of centralized governmental authority and a judiciary subjugated to the executive branch has fostered a weak judicial system. These problems are even more exaggerated at the state level where executive and judicial functions have historically been fused.

[111] Siba, E,G. 2008.Determinants of Institutional Quality in Sub-Saharan African Countries. JEL Classification: F35, N40, N47, p.18.

[115] It is important to mention here that Proclamation 83/94 is amended and replaced by Proclamation No. 591/2008.

[116] OECD Principles of Corporate Governance, 2004, p.49.

[117] Banking Business Proclamation No. 592/2008: Part Seven, Art 28

[119] Each of the five sample banks in the study hesitate to give audited financial reports prepared by the bank’s annual financial bulletin let alone posting it on their business places.

[120] Banking Business Proclamation No. 592/2008: Part Three, Art 10 (2) and (5). The writer of this paper requested the Finance Department of each of the five sample banks to disclose the voting rights of shareholders of the banks but her request was persistently denied by the banks’ department.

[121] Licensing and Supervision of Banking Business: Directive No. SBB/39/2006 Amendment for New Bank Licensing and Approval of Directors and CEO.

[122] Banking Business Proclamation No. 592/2008: Part Six, Art 26 (1) and Art 27; Art 370 of the Commercial Code; Licensing and Supervision of Banking Business: Directive No. SBB/19/96 Approval of an Independent Auditor.

[123] Banking Business Proclamation No. 592/2008: Part Six, Art 27(3).

[124] Banking Business Proclamation No. 592/2008: Part Four, Art 14-16; Licensing and Supervision of Banking Business: Directive No SBB/39/2006 Amendment for New Bank Licensing and Approval of Directors and CEO.

[127] Ibid. The candidate shall be a person with high honesty, integrity, reputation and diligence to the satisfaction of the bank.

[128] Ibid. The candidate must have a minimum of first degree or equivalent from a recognized higher institution of learning; a minimum of ten years experience in banking of which a minimum of five years in senior managerial position; at least 30 years old, and preferably be married or responsible to a family.

[129] Redda, A. Abie Sano Bounces Back Poser for Central Bank.2009. Addis Fortune,28th November,p.1.

The ten years managerial experience provided in the directive is simply set aside as individuals having six years and less are appointed as presidents of the state owned bank of CBE.

[131] NBE Risk Management Guideline, May 2010, p.1-2. www.NBE.gov.et

[132] Banking Business Proclamation No. 592/2008: Part Five, Art 18 and Art 20.

[133] Ibid: Part Five, Art 21(7).

[134] Kiyota, K, Peitsch, B, and Stern, R, M. 2007. The Case for Financial Sector Liberalization in Ethiopia, Research Seminar in International Economics, Discussion Paper No.565,p.4

[135] The History of Banking and Other Financial Institutions in Ethiopia.2010.[online]. [Accessed 28 November 2010].Available from World Wide Web: ¡Error! Referencia de hipervínculo no válida. Subsequently, Dashen Bank, Abyssinia Bank, Wegagen Bank, and United Bank were established chronologically from 1996 to 1998.

[136] Interview with NBE Bank Inspection Head on November 4,2010

[137] The writer had directed a question to the Finance Department of each bank to list the top five share holders with their holdings, only two banks give the information after persistent request and persuasion for a purely academic purpose. The other three banks insisted that it is very confidential. All this indicates corporate disclosure and transparency is a major problem in privately owned commercial banks in Ethiopia.

[138] Interview with the Finance Department Head of Dashen Bank on October 18, 2010.The owner of Midrock Group of enterprises, a privately held diversified conglomerate, is a Saudi-Ethiopian Billionaire. Dashen Bank is one of the enterprises under Midrock Ethiopia and the bank has not sold Shares to the public since its establishment in 1995.

[139] Kiyota, K, Peitsch, B, and Stern, R, M. 2007. Supra Note134.

See also Banking Business Proclamation No. 592/2008, Part Two Art.9: “Foreign nationals or organizations fully or partially owned by foreign nationals may not be allowed to open banks or branch offices or subsidiaries of foreign banks in Ethiopia or acquire the shares of Ethiopian banks.”

[140] Teshome, A.2007. The Compatibility of Trade Policy with Domestic Policy Interventions in Ethiopia, Paper Presented at a Workshop on Staple Food Trade and Market Policy Options for Promoting Development in Eastern and Southern Africa, March 1-2, 2007, P.12.

The major benefit of increased competition between banks should be in setting the interest rate.

[141] Kiyota, K, Peitsch, B, and Stern, R, M. 2007. Supra Note 139.

The three state owned banks are: Commercial Bank of Ethiopia (CBE), Development Bank of Ethiopia (DBE), and Construction and Business Bank (CBB).

[142] Ibid, p.7; Integrating Financial Services in to the Poverty Reduction Strategy in the case of Ethiopia [online].[Accessed 9thDecember 2010]. Available from World Wide Web:http://www.africa.org/publications/511Ethiopia-Final.ppt

Evidently the Ethiopian banking sector is dominated by one large state-owned bank, the Commercial Bank of Ethiopia (CBE). In 2004, the asset share of the CBE was 66.3 percent, while the share of all three state-owned banks was nearly 80 percent. These results clearly indicate the dominant state control of the Ethiopian banking sector.

[143] Kiyota, K, Peitsch, B, and Stern, R, M. 2007. Supra Note 141.

[144] Private Sector’s Responses to the Current Global Financial and Economic Crisis: The Case of Ethiopia, Prepared by EEA to the International Labour Organization, April 23, 2009 Addis Ababa, Ethiopia, p.11-12; Wyplosz, C. How Risky is Financial Liberalization in the Developing Countries? Research papers for the Intergovernmental Group of Twenty-Four on International Monetary Affairs, United Nations, New York and Geneva, Septemeber 2001,p.20

[145] Ibid. In this context, the absence of foreign banks in the Ethiopian financial system has turned out to be a blessing in disguise.

[146] Wyplosz, C. Supra Note 144,p.20-21. It may be useful to wait until a proper economic, and possibly political, infrastructure has been built in Ethiopia. The strategy that has not been proven wrong so far is to start with liberalization of the domestic goods market, then to open up to trade, and then to proceed to domestic financial liberalization, before finally opening the capital account.

[147] Jensen, M,C, and Meckling,W,H.1976. Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure. Journal of Financial Economics,3(4),pp.1-77.Available at: http://ssrn.com/abstract=94043; Morck,R, Shleifer,A and Vishny,R,W.1988.Management Ownership and Market Valuation. Journal of Financial Economics,20, pp 293-315; McConnell, J, J, and Servaes, H.1990.Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27, pp. 595-612.

[148] McConnell, J, J. 1990.Additional Evidence on Equity Ownership and Corporate Value. Journal of Financial Economics, 27, p.596. See also Demsetz, H.1983 The Structure of Ownership and the Theory of the Firm. Journal of Law and Economics, 26(2),pp.375-390; Demsetz, H, and Lehn, K.1985. The Structure of Corporate Ownership: Causes and Consequences. The Journal of Political Economy, 93(6), pp.1155-1177

[150] Brickley, J, A, and James, C, M.1987.The Takeover Market, Corporate Board Composition, and Ownership Structure: The Case of Banking. Journal of Law and Economics,30(1), p.171; Shleifer, A and Vishny, R, W. Supra note 41,p.754.

[152] Okpara, J, O. 2010.Perspectives on Corporate Governance Challenges in a Sub-Saharan African Economy. Journal of Business & Policy Research,5(1), P.111; Shleifer,A, and Vishny, R, W.1997.Supra Note 150,p.758-761;OECD Principles of Corporate Governance, 2004, p.42.

Large shareholders may also engage in the extraction of direct private benefits via high pay and bonuses for employed family members and associates, inappropriate related party transactions etc.

[153] Shleifer,A, and Vishny, R, W.1997.Supra Note152, p.739.

[154] In an interview with Awash Bank Finance Department Head on September 22, he indicated that some investors express their disappointment of the legislator’s restriction on the amount of shares as it limits them from investing the maximum level they want.

[155] In addition, it says that influential shareholders of the bank shall meet the fitness and propriety criteria prescribed by the National Bank. Correspondingly, Art 13(2) prescribes that NBE may suspend the voting rights of an influential shareholder who fails to fulfill ethical and propriety requirements of the NBE.

[156] Shleifer,A, and Vishny, R, W.1997.Supra Note 153,p.164.

[157] Interview with Dashen Bank Finance Department Head on October 26, 2010.

[158] Spong,K,R, and Sullivan, R, J.2007.Corporate Governance and Bank Performance. Journal of Economics Literature No.G21, G34, p.6.

[159] Kirkpatrick, G. 2009. The Corporate Governance Lessons from the Financial Crisis, Financial Market Trends – ISSN 1995-2864 -OECD, p.3; Corporate Governance and the Financial Crisis: Key Findings and Main Messages, OECD June 2009,p14-20.

[160] Summary of Walker Review on Corporate Governance in UK Banks and Other Financial Industry Entities, International Centre for Financial Regulation, 2009,p.19; See also Kirkpatrick, G. 2009. Supra Note 159.

[161] Cheffins, B, R.2002. Corporate Law and Ownership Structure: A Darwinian Link? University of New South Wales Law Journal, 25(2),p.349-350.

[163] Coffee, J, C. 2001.The Rise of Dispersed Ownership: The Role of Law and State in the Separation of Ownership and Control. The Yale Law Journal,111(1), p.3.

As it has been clearly indicated under Chapter two corporate disclosures in Ethiopian banks is at a rudimentary stage since it is difficult to get shareholders data for academic purpose it would be much more so for the investing public that looks for a target company’s net worth. Banks do not post their financial information in their place of business as well as in news papers.

[164] For instance, the presence of party affiliated banks creates unbalanced competition environment in the banking industry; furthermore all of the banks financial statements are not in the public domain.

[165] Shleifer, A, and Vishny, R,W. 1997. Supra Note 156, p.754.

[166] Uadiale, O, M. 2010.The Impact of Board Structure on Corporate Financial Performance in Nigeria. International Journal of Business and Managemt,5(10),p.156.

[167] Agoraki, Maria-Eleni, Delis, and et al.2009. Supra Note 36, p.2.

[168] Uadiale, O, M. 2010. Supra Note 179,p.166; Ibid,p.13-14.

The number of NEDs could be used as a proxy for board independence, however, ‘independent directors’ are not one and the same with NEDs but they constitute a sub-group of NEDs, bearing distinctive qualities such as not being employee of the company or its affiliates, not be closely related to the company or its management through significant economic, family or other ties, not be representative of or having close business ties with dominant shareholders, not be significant creditor or supplier of the company, etc.

[169] Enhancing Corporate Governance for Banking Organizations, Basel Committee on Banking Supervision, February 2006, p.7; Uadiale, O, M. 2010. Supra Note 168.

[170] Andres, P and Vallelado,E. 2008. Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance, 32,p.2572; John, K, and Senbet, L, W. 1998. Supra Note 11, p.380; Uadiale, O, M.2010. Supra Note 168.

[171] OECD Principles of Corporate Governance, 2004,p.64-65; Fama, E, F, and Jensen, M, C.1983.Separation of Ownership and Control. Journal of Law and Economics,26, p.18-19.

[172] Agoraki, Maria-Eleni, Delis, and et al.2009. Supra Note 167,p.17.

[174] John, K, and Senbet, L, W. 1998. Supra Note 170,p. 386-387.

[175] Report of the Committee on the Financial Aspects of Corporate Governance (the Cadbury Report), December 1, 1992, Paragraph 4.30, 4.35, and 4.42; Committee on Corporate Governance (The Hampel Report) January 1998, p.29,36, and 49; Suggestions for Good Practice from the Higgs Report, Financial Reporting Council, June 2006,p.7-9; King Report on Corporate Governance for South Africa, Cliffe Dekker Attorneys, 2002,p.4-6. www.cliffedekker.com

[176] Summary of Walker Review on Corporate Governance in UK Banks and Other Financial Industry Entities, International Centre for Financial Regulation, 2009,P.8

[177] Sarkar, T, Jay, S, and Manley, G.2010.An Analysis of the Walker Review of Corporate Governance in U.K Banks and other Financial Institutions. The Banking Law Journal,127(3),P.244.